At one time the United States controlled 66% of all gold in the world. This was the time when the US dollar had backing of gold. This means if there is a $1 note then $1 worth of gold should be reserved for its backing. But when that backing was lost, the big central banks got full control. They can print as much money as they want. Due to this the value of money is decreasing.

Today many US parties, ministers etc. are saying that gold backing is necessary. When it is removed, printing is done willingly. Due to this, one has to bear the pressure and pay taxes. Many politicians are saying that we should go back to the gold standard.

Donald Trump is the new president and he says moving away from the gold standard was a mistake.

Gold Standard Or Bitcoin standard

Can the gold standard come back and then banking be done on the bitcoin standard? This has to be seen in the coming time.

What is America’s Golden Age and 4th March Relation?

Since Donald Trump came to power, he says that America’s Golden Age has just begun. Regarding this, there is going to be a joint session on 4th March in the US Congress where Donald Trump will go. Donald Trump’s inauguration took place on 20th January, and he has gone on 4th March.

There are two important things in this inauguration. First Golden Age and second 4th March. There is an old relation between Gold and 4th March. Which changes a lot of things.

The Great America Depression

Whenever a new President comes to power in the US, the inauguration takes place which nowadays it happens on 20th January. But since 1933, the last inauguration used to take place on 4th March. The last President of the United States was Franklin D. Roosevelt on 4th March 1993. He was the 32nd President of the United States. When he became President, the United States was going through a very big crisis. At that time the Great American Depression was going on. The stock market here has been crashing since 1929. There are no jobs, there is no way to eat.

What was the problem at that time?

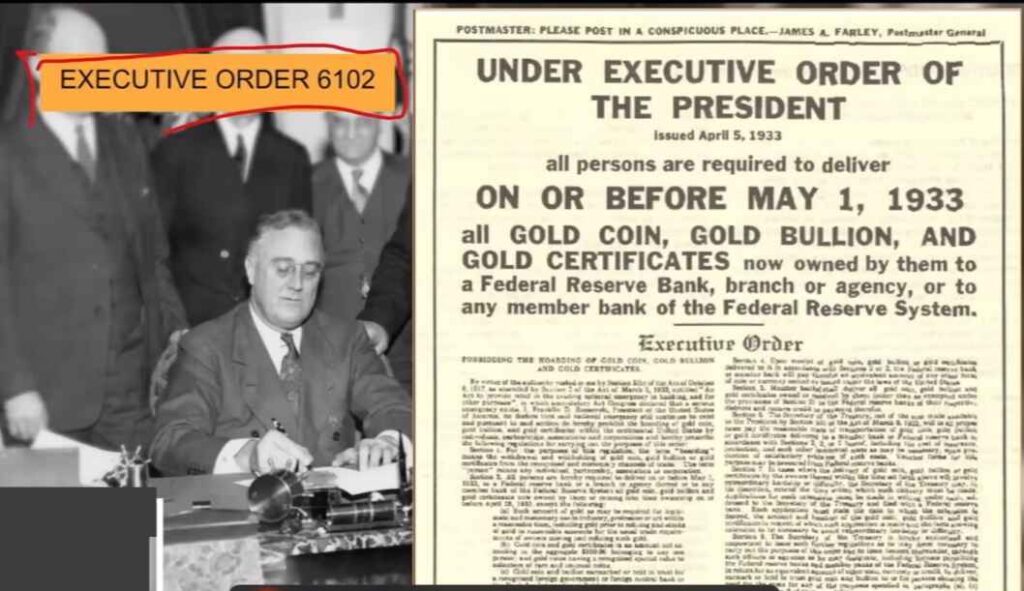

At that time dollar was gold backing. Gold was required for printing but gold was limited. Government had limited gold but people had a lot of gold.

To come out of that crisis, he would ban gold. He implemented Executive Order 6102. According to that, any US citizen holding gold can be jailed for 10 years and can also get a fine of $10,000. The US Government has said that holding gold is illegal, deposit it with us. In return we will give you dollar notes which will be backed by gold. You cannot hold gold, the Government will hold it.

The Gold Ban was created in 1933, from where gold holdings sky rocketed.

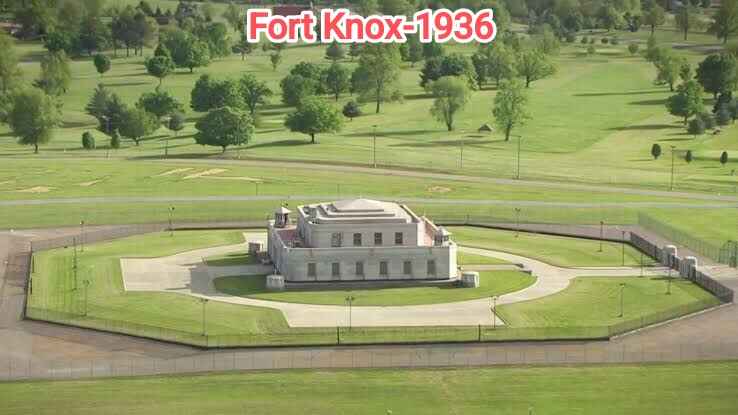

What is Fort Knox? Where was the gold kept?

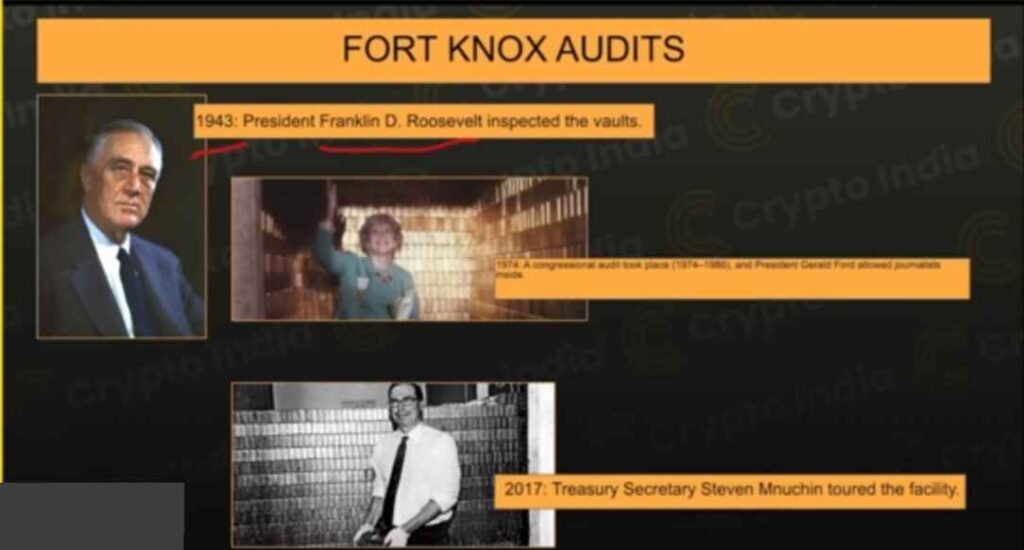

Fort Knox was built in 1936 to keep the gold safe. Even now most of the gold is kept in reserve here. This is a highly secured place. The Constitution and Declaration of Independence documents of the United States are kept here.

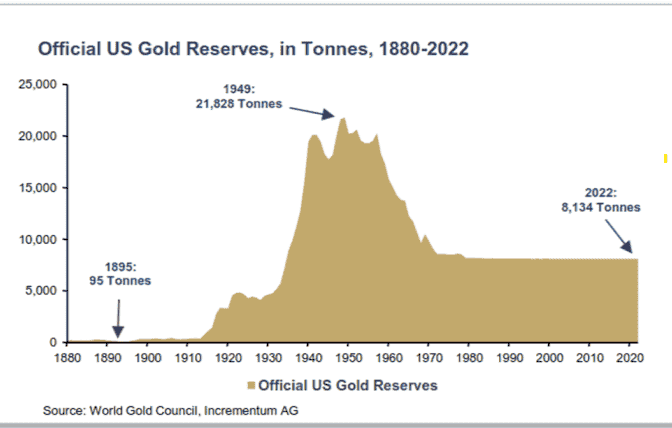

When gold was banned, about 13,000 tons of gold was kept in Fort Knox.

How did the United States increase?

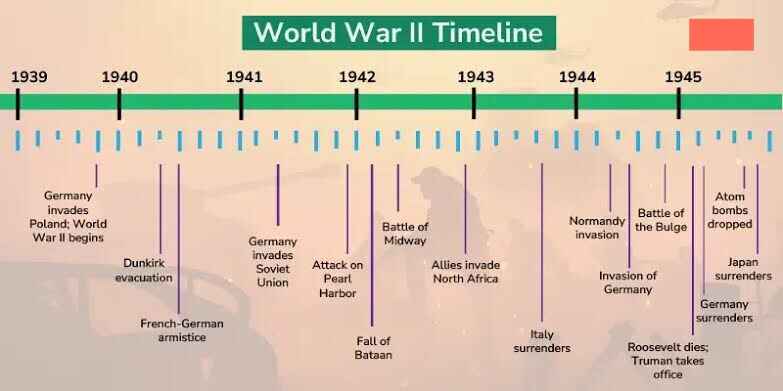

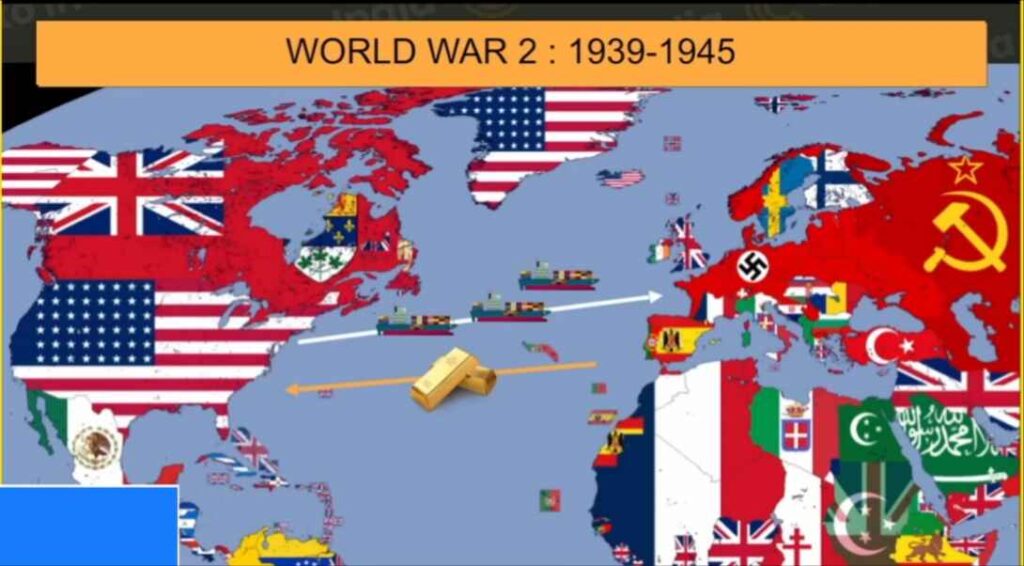

In the meantime World War 2 started. It started in 1939, which actually started in 1940. Germany invaded Poland. But the Great Depression in America had started in 1929, and ended in 1940, when World War 2 started. Good days for America started in 1940. The whole of Europe was fighting, all the factories started making weapons. Manufacture of consumer goods stopped. Farming was also not happening. America had an advantage, that is, on a separate island. The United States told the European countries that if they want consumer goods, we will give it, give them gold in return. Whatever gold you can keep safe, that too. The war went on from 1939 to 1945, the US earned a lot of gold. America increased this.

Bretton Woods System

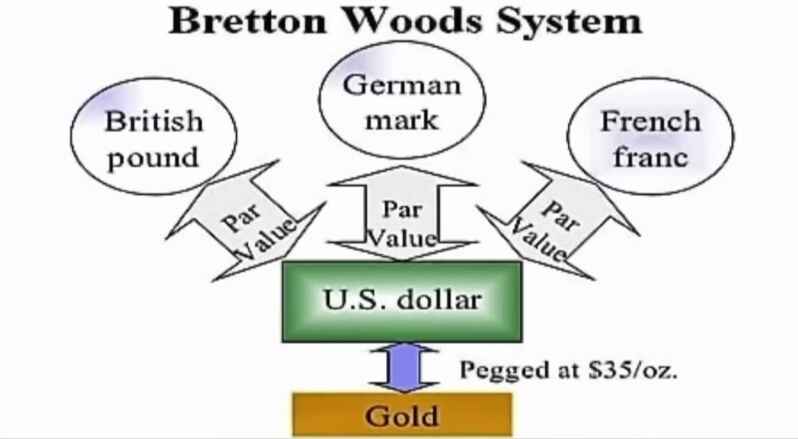

In 1944 Bretton Woods meeting was organised. 44 countries participated in it. US said that US dollar is strong, dollar is backed by gold. You should back your currency with US dollar. This was created as a monetary system. US dollar will be backed by gold, dollar will be based on the currencies of other countries. Everyone agreed.

When did the United States Enter the War?

In 1949 America’s gold hold was around 21,828 tons, 66% of the world supply. America became a superpower. World War II ended in 1945.

In 1947 the Cold War between the US and Russia started. From 1950 to 1953 there was the Korean War, where America entered. In 1955 there was the Vietnam War, go there and fight the war. When wars happen, things happen, they will have to do a lot.

Bretton Woods System Cancelled?

In 1960 the President of France said that if we do not consider the dollar as reserve, we will keep gold in reserve. Give us our gold back. Then other countries started taking gold. The gold reserve that America had done during the war also came out of that reserve. The gold reserve which was at an all time high started falling. At that time President Nixon closed down the Bretton Woods System in 1971, removed the gold backing of the US dollar. The US dollar became free, the currencies of other countries also became free. The current monetary system is running like that. America will have a gold reserve of 8,134 tons till 2022.

Even today, if we look at the wealth of any country, what matters is the amount of gold reserves they have. Even today countries buy gold and keep it because it is actually money. America says that 56% of the gold is kept in Fort Knox, around 4,584 Tons. The rest is kept elsewhere.

Is there Gold in Fort Knox or not?

Now people say that there is not as much gold in Fort Knox as they claim. People said that audits should be done, but there have been no audits yet. Till now 3 audits have been done, but people say that these are not proper audits. Some say that it is fake gold.

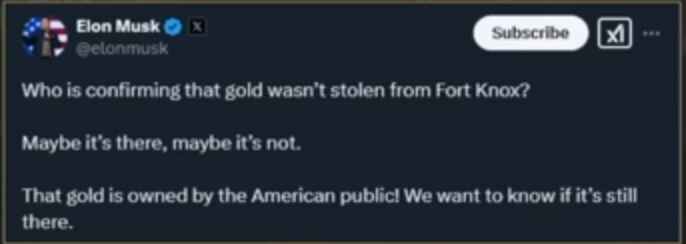

Elon Musk says we should check how much gold is there.

Donald Trump says we will go to Fort Knox to check it.

Disclaimer

Neither crypto wah, nor any of its personnel, representatives, agents, or independent contractors are licensed financial advisors, registered investment advisors, or registered broker-dealers. None of the Operator Parties is providing investment, financial, legal, or tax advice, and nothing in this article should be construed as such by you.This article should be used as an educational tool only and are not a replacement for professional investment advice